Being VAT Registered is Killing My Business: Navigating Financial Strain VAT (Value Added Tax) registration is a critical turning point for many businesses. Reaching the threshold where VAT registration is mandatory often appears as a sign of growth and success, yet for some companies, it marks the beginning of challenging times.. "Being VAT registered is killing my business" is a common complaint amongst many small business owners who begin to feel the pinch after VAT.

How to VAT Registered Premier Software

Do I need to be VAT registered? The pros and cons for businesses and tradespeople Rated People

Pros and Cons of Being VAT Registered

Pros & Cons of Being VAT Registered (Advantages, Disadvantages)

How To Pay VAT Online? Proven 6 Easy Methods Included

Being VAT registered is killing my business

How can I stop being VATregistered? 03 December 2014 Premium

New penalty 2022 Header

Exceptions to being VAT registered AccountingWEB

How VAT works and is collected (valueadded tax) Novashare

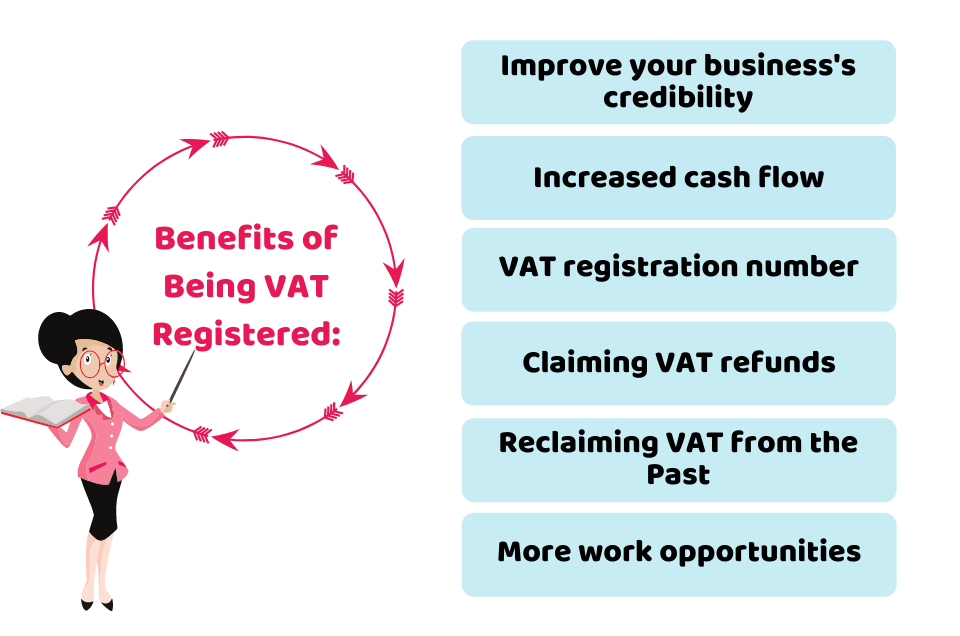

What are the Benefits of Being VAT Registered? CruseBurke

Should My Business Be VAT Registered (UK2021) Cooper Financials

Being Vat Registered Is Killing My Business A Detailed Guide

The Five Big Benefits of Being Vat Registered in the UK The Good Men Project

What are the Benefits of Being VAT Registered? CruseBurke

The benefits of being VAT registered YouTube

VAT or nonVAT What should you choose? JCSN Accounting Services

Do I need to be VAT registered? The pros and cons for businesses and tradespeople Rated People

Pros And Cons Of Being Vat Registered

Killing Is My Business... And Business Is Good! The Final Kill》 Megadeth的专辑 Apple Music

Setting up NewCo. With the new company, do the maths, assuming VAT is payable. Make sure your business model allows for VAT. Do not that, if HMRC see a new company set up, where one or more of the Directors were Directors of a company that went into liquidation owing VAT (or PAYE, etc), then HMRC have power to demand Security of the new company.. Of course, an obvious choice. Probably the most logical benefit of being VAT registered in the UK is the ability to reclaim VAT on your purchases where applicable. As a business owner, you will now enjoy the advantages of being VAT registered by getting back 20% of the cost of goods and services that you had previously missed out on.